Farm Credit Illinois Patronage Program

Many businesses declare annual dividends to investor-owners based on their stock ownership. But as a cooperative, Farm Credit Illinois distributes cash patronage to borrower-owners proportionally based on their annual business contributions.

In 2023, FCI distributed $40 million of cash patronage the week of June 19.

The Board’s decision to return 43.4% of the Association’s 2022 net earnings to borrower-members follows a year of strong portfolio growth and steady earnings. This represents the fifth consecutive year of cash patronage distributions. On average across the entire portfolio, patronage lowered the effective interest rate on loans by 1.00%.

Member Economic Participation

In true cooperative spirit and demonstrating Member Economic Participation – a guiding principle of all cooperative businesses – patronage is allocated based on the business value each member contributes to the cooperative.

Patronage is another way FCI delivers cooperative value to members and the marketplace, while remaining committed to providing low upfront interest rate pricing, a strong capital position for the future, and initiatives supporting members and their local communities.

For more information on cash patronage, contact your local office or email ask@farmcreditIL.com.

Frequently Asked Questions

-

How is patronage calculated?

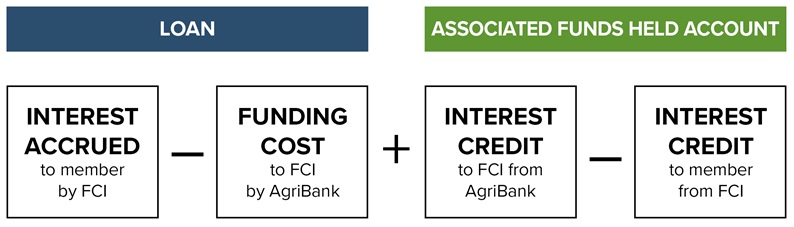

Members will be paid proportionally based on their 2024 net interest margin contributions of their patronage-eligible loans and associated Funds Held accounts.

Factors impacting each loan’s unique net interest margin contribution include the loan type and terms, market conditions at loan closing, and the usage of Funds Held.

-

When and how will patronage checks be delivered?

Patronage checks will be dated June 9 and are expected to arrive that week. Patronage is paid to eligible borrowers who are allocated a patronage payment of $25 or more.

-

How does patronage provide an effective interest rate reduction for members?

Cash patronage returns a portion of the interest accrued during the previous year. Over the past four years and across the entire member loan portfolio, cash patronage reduced effective interest rates on average by nearly 1.0%.

A member’s overall effective interest rate reduction (patronage earned divided by the average daily balance of all patronage-eligible FCI loans) will be calculated at the bottom of the patronage breakout table on the letter attached to their check.

-

How do FCI’s business segments impact cash patronage?

As cooperative membership and loan volume grow, the Association improves its overall cost and business efficiencies. There is a direct link between this increased business and FCI’s ability to deliver greater member value. Members also benefit from the cooperative’s diverse revenue streams including:

- Crop insurance premiums

- AgDirect equipment financing

- Rural 1st® country life loans

- ProPartners input financing

- Capital Markets Group agribusiness loans

- Agri-Access secondary market agricultural financing

-

Will interest rates go up to pay patronage?

No – FCI remains committed to being competitive on interest rates. For many years, FCI has offered some of the lowest interest rates in the nation among Farm Credit Associations and intends to keep this System position.

-

Is my patronage payment taxable income?

Because every FCI patronage check is for at least $25, every individual and business who receives a patronage check will receive a corresponding IRS Form 1099-PATR the following year. Consult a tax professional with any tax-related questions.

-

Why doesn’t Farm Credit Illinois distribute all of its earnings as patronage?

Capital not distributed as patronage is retained to ensure the cooperative remains financially stable and in a strong capital position while delivering competitive interest rates, capitalizing for current and future growth, supporting member and marketplace initiatives, and carrying out its mission of Helping Farm Families Succeed.

-

Who will be the payee on the patronage check?

One check will be issued per primary borrower and be made payable to the primary borrower. An itemized listing of each affiliated loan’s patronage amount will be provided. Both business entities and individuals will receive patronage checks.

-

Why did FCI begin paying patronage?

FCI’s Board of Directors had been considering patronage for a number of years, but first built a strong capital foundation to ensure the Association would remain financially stable and in a position to achieve business priorities even when distributing patronage.

In 2018, the Board formally adopted a cash patronage program to become part of the member-borrower experience while still providing competitive interest rates, a strong capital position for the future, and initiatives supporting members and their local communities.