Farmland Value Benchmark Study Results

-

August 6, 2021

August 6, 2021

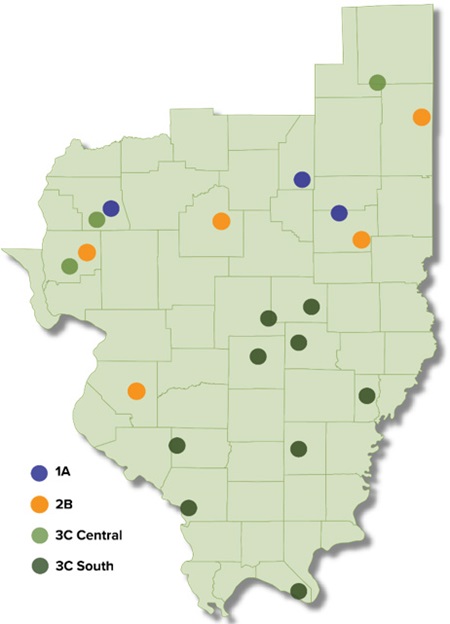

Each year the Farm Credit Illinois (FCI) appraisal team evaluates the same 20 benchmark farms throughout its 60-county territory based on the land’s productive index (PI) rating, as calculated by the University of Illinois’ Bulletin 811. Based on individual PI ratings, farms are divided into four categories: 1A, 2B, 3C Central, and 3C South.

Land Value Results Strong

Land values in the central and southern 60 counties of Illinois increased for the third consecutive year, according to the annual benchmark study. On average, the benchmarks were up 8.54%.

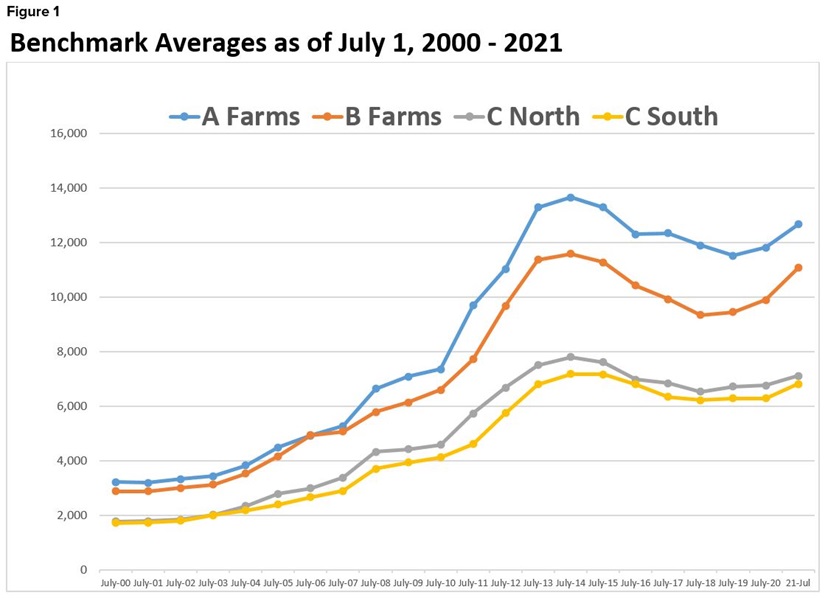

As seen in Figure 1, land values had a dramatic run-up beginning in 2003, until the peak in 2014. Results began their first decline in more than a decade in 2015 and continued a slight decline through 2018.

Figure 1: FCI’s average benchmark study results by land class on July 1, 2000-2021. Source: FCI 2021 farmland value benchmark study

The 2021 study reflected an increase of 8.54% with 18 of the 20 benchmark farms increasing and two unchanged.

Results across all land classes showed considerable variation, reinforcing the fact that agricultural real estate is a location-specific asset. When considering the individual benchmark values, the year-over-year percentage changes ranged from 0% to +20.51%.

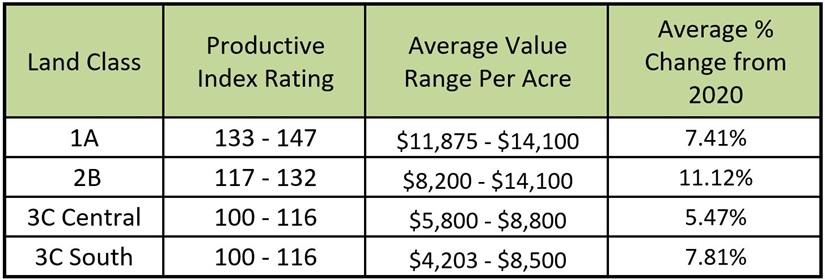

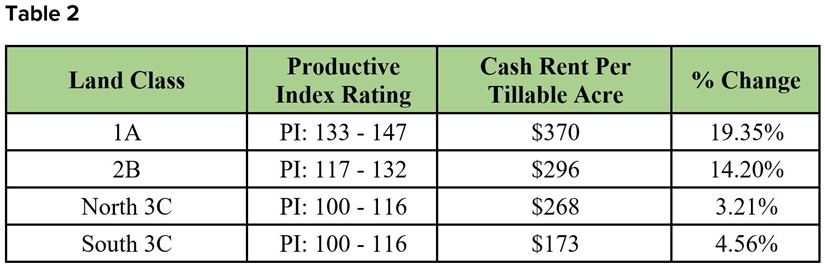

The table below illustrates the average changes in the four general land classifications. Class 1A and 2B benchmark farms are mostly located in central Illinois, whereas the Class 3C farms are located in both central and southern Illinois. These farms are tracked separately based upon their location. Benchmark farm locations are plotted and categorized by land class on the map.

Table 1: Average percent change in overall value from 2020 by land class. Source: FCI 2021 farmland value benchmark study

Commodity Prices in Relation to Land Values

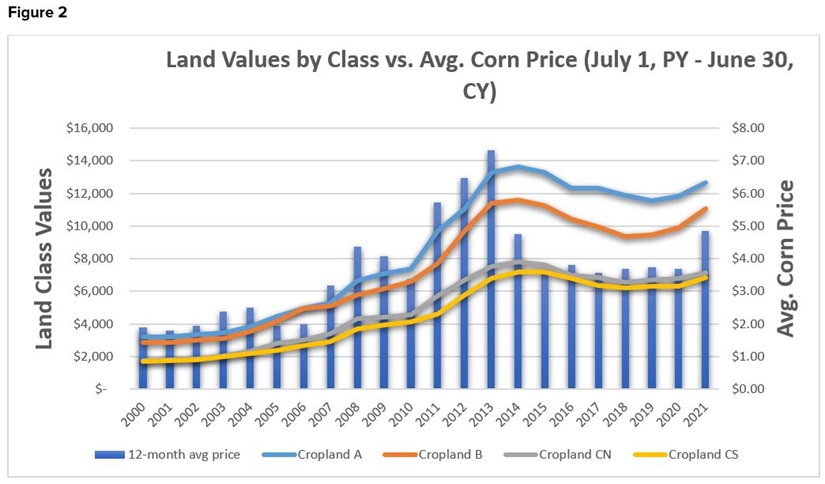

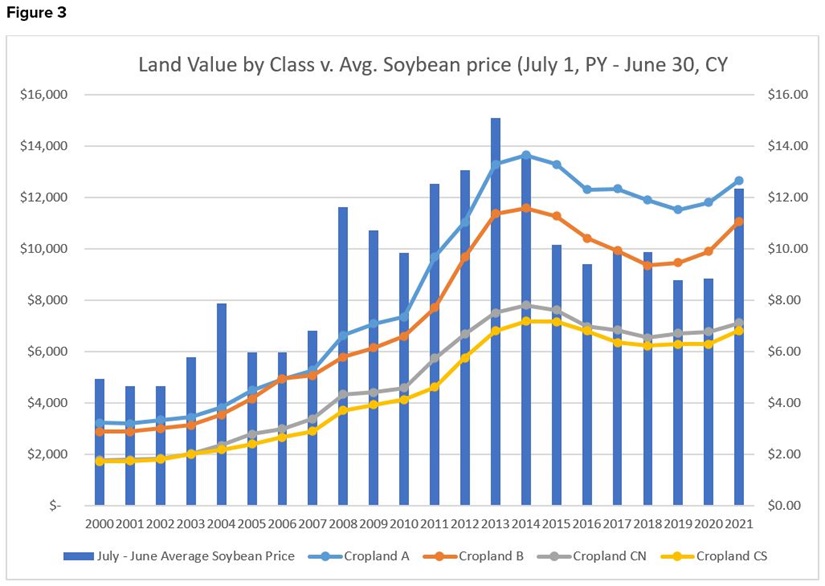

While higher commodity prices helped fuel the dramatic increase in land values from 2009 to 2014, lower commodity prices lead to declining values from 2015 through 2018. Recently, strong commodity prices have been one factor in the increase in 2021 farmland values. Figures 2 and 3 demonstrate the relationship between land values and corn and soybean prices.

Figures 2 and 3: Average corn and soybean price in relation to FCI annual benchmark study results by land class annually on July 1, 2000-2021. Sources: Macrotrends.net and FCI 2021 farmland value benchmark study

Other Factors Affecting Land Values

A primary factor in the strong land values continues to be the strong demand for Illinois farmland with a limited supply of farms for sale. Buyers are primarily a mix of operating and retired farmers and experienced farmland investors with ties to the area.

A post-harvest bump in commodity prices helped fuel stronger income in 2020, in which a large portion was generated from cash sales across the scales at the time of delivery. Overall, agriculture has weathered the pandemic, with commodity prices increasing and strong demand for U.S. production.

Recent Market Facilitation Payments and pandemic assistance programs (PPP loans) from the federal government have helped stabilize balance sheets, increase working capital, and create a more positive outlook in agriculture.

Continued low interest rates also contribute to the strong land market.

Crop conditions throughout the FCI territory are mostly positive. Illinois corn conditions reported Aug. 1, 2021 by the USDA show 26% Excellent, 42% Good, 26% Fair, 4% Poor, and 2% Very Poor. Soybeans are rated at 24% Excellent, 43% Good, 26% Fair, 5% Poor, and 2% Very Poor.

Cash Rental Trends

Cash rents varied this year depending on when they were negotiated. As illustrated in the table below, average changes to cash rent in the four land classes varied. Cash rents studied were from the previous year and upcoming fall. Overall, cash rents were trending higher.

Table 2: Average percent change in overall cash rent since 2019 by land class. Source: FCI 2021 farmland value benchmark study

Summary

The 2021 benchmark update for the Farm Credit Illinois territory shows a strong land market. 18 of the 20 benchmarks showed increases in value with two benchmark farms unchanged. The variability of increases in the FCI territory reinforce the fact that agricultural land is a location specific asset.

The economic health of farmers and farm owners is mostly stable, but there still is pressure on farmers’ financial positions. Forecasted higher input prices including anhydrous and rising cash rents will be a challenge for the upcoming planting season.

Overall, an increase of 8.54% indicates a robust market throughout FCI’s 60-county territory. Values for 2021 are nearing the all-time highs of 2014.

-

Tag Cloud

Land Classes Farm Credit College Community Improvement Grants Dr David Kohl land sales FOMC 4-H farmland auctions FFA Auction Results Education grants employees patronage Farm Interest Rates KOHL-laborations Weather Outlook Essentials Newsletter Land Values Weather scholarships appraisals rural marketplace investment