The Cooperative Advantage for Farm Families and Ag Borrowers

-

February 1, 2022

February 1, 2022

Membership and Ownership Create Tangible Value

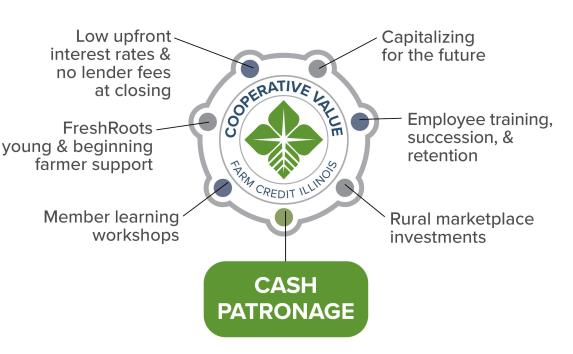

While most businesses are motivated by the returns they earn for their investor-owners, the success of a cooperative business is expressed through the value delivered to its member-owners. Without investor-owners, lending cooperatives strive to understand the needs and preferences of their borrower-owners and design products and services that deliver the greatest cooperative value.

Consider the cooperative advantage when searching for a lender.

1. Patronage dividends based on participation

A cooperative’s cash patronage is distributed equitably based on each member’s participation in the business – a contrast to companies that pay dividends based on stock ownership at the cost of the customers. Since patronage pays proportionally to contributions, you reap financial rewards from your membership and lower your overall cost of products and services from the cooperative.

2. Tailored loan terms, competitive interest rates, and minimal fees

Cooperatives listen to member-owners requesting new products and services and want to provide the tools needed to succeed. Inquiring about programs available for your specific business model may provide savings and flexible payment options.

3. Agricultural expertise and on-farm service

Part of the value created by a cooperative is expertise in the field. Finding a lender with ag experience who will meet you on the farm will save you valuable time while informing your relationship.

4. Committed to their industry

Since cooperatives serve their member-owners, they are dedicated to seeing their industry grow and thrive. Working with a cooperative committed to Helping Farm Families Succeed provides peace of mind through both the prosperous and challenging times of agriculture.

5. Support to the local community

Cooperatives are called to serve the local communities in which their employees and members live. Doing business with a local lender who gives back – financially and by volunteering – helps your community prosper.

Farm families considering Farm Credit Illinois for their next ag loan should consider the cooperative advantage.

-

Tag Cloud

Community Improvement Grants FOMC Farm FFA 4-H employees Land Values Weather Outlook liquidity Focus on Farming calendar scholarships Financials security Interest Rates Land Classes Essentials Newsletter patronage farmland auctions cash flow Weather Auction Results Farm Credit College Calendar contest land sales Dr David Kohl rural marketplace investment balance sheet Education appraisals