Dairy Revenue Protection Program Announced

-

December 3, 2018

December 3, 2018

Dairy Revenue Protection (DRP) is a new federally subsidized insurance plan specifically for dairy producers. DRP protects revenue based on price and production.

Coverage is provided on declines in quarterly revenue from milk sales relative to the guaranteed coverage level.

DRP is an area-based plan of coverage and does not insure a dairy’s individual milk production. Production for the insurance period will be determined on the state-level with milk production reports from the National Agricultural Statistics Survey.

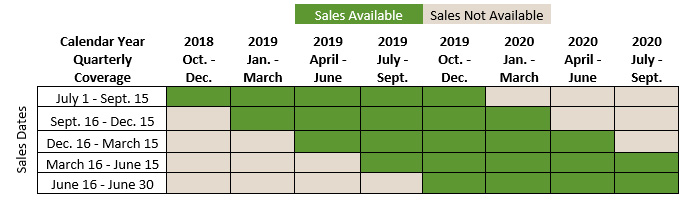

Coverage is available quarterly and can be purchased into the next year. Daily quotes are available for up to five quarters and endorsements may be purchased daily. The chart below details the purchasing windows.

To determine the level of coverage, dairy producers must decide on the following:

- The value of the milk protected – class or component pricing

- Class Pricing – uses Class III or Class IV futures prices

- Component Pricing – uses component milk prices for butterfat protein

- The amount of milk production to cover

- Determined by the producer and can be less than the actual quarterly estimated production.

- Coverage level from 70-95% with a protection factor up to 150%

- Quarterly endorsement based on the current sales period

Contact your local crop insurance agent to learn more about how Dairy Revenue Protection can work for your operation.

-

Tag Cloud

farmland auctions Education balance sheet Farm Credit College Farm cash flow employees Weather land sales Community Improvement Grants Focus on Farming calendar 4-H Weather Outlook Dr David Kohl scholarships Calendar contest liquidity Land Classes Financials Land Values Essentials Newsletter appraisals Auction Results Interest Rates FFA FOMC rural marketplace investment security patronage