FOMC Update

-

June 7, 2023

June 7, 2023

INTEREST-ing Times

FOMC Update

The Federal Open Market Committee (FOMC) of the Federal Reserve (Fed) met May 2-3 and voted to increase the Fed Funds rate by 0.25%, bringing the overnight rate to 5.00-5.25%. Since its March 16, 2022 meeting, the FOMC has increased the rate by 5.00% over the course of 14 months encompassing 10 meetings which is the most rapid set of rate increases in over 40 years. The Fed cited a continued strong labor market including a low unemployment rate, continued elevated inflation, and repeated its stated goal to bring inflation down to its 2% target over time.

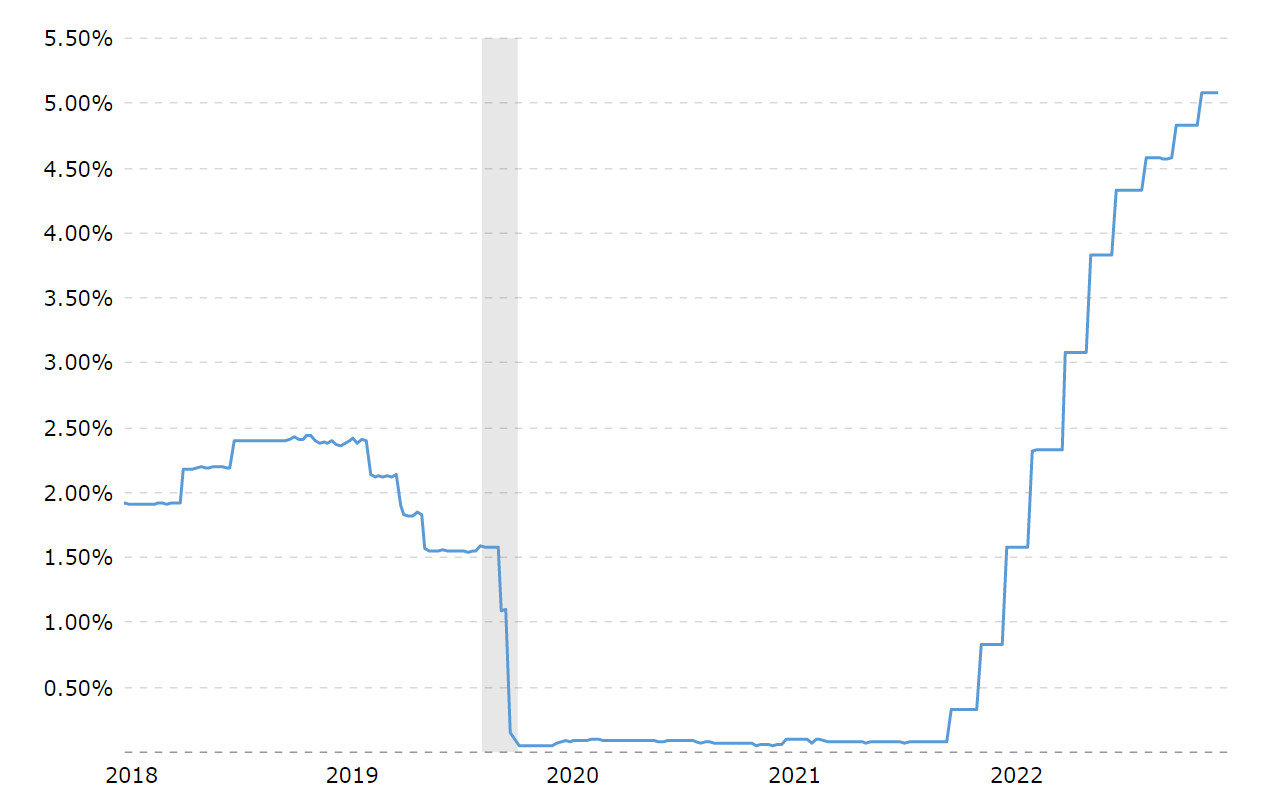

Here is a chart of the Fed Funds rate over the last 5 years:

Source: https://macrotrends.net – 5 year historical trend

The rapid rate increases have been especially painful because the Fed Funds rate has been at or near zero for the majority of the last 15 years. The combination of the rapidity of the rate increases, coupled with the sheer magnitude of 500 bps of increase, has been challenging for capital intensive industries that rely upon short term debt financing to fund operations.

The next meeting for the Fed is June 13-14 and the Fed Funds futures market is predicting a 65% likelihood of another 0.25% increase in the Fed Funds rate at that meeting. This meeting will also include the quarterly update to the Fed’s Summary of Economic Projections by the Fed Governors and Regional Fed Presidents. The SEP will show the range of projections for GDP, unemployment rate, inflation, and the Fed Funds rate for the year-end, 2024-2025, and the longer range.

Inflation Remains Elevated - Why?

The Fed continues to grapple with an inflation rate that is well above its stated 2% target even after the rapid increase in its Fed Funds rate and the quantitative tightening actions (the Fed continues to reduce its balance sheet by roughly $95 Billion per month by not reinvesting all of the funds generated by the maturation of its existing Treasury and mortgage-backed securities). The most recent Consumer Price Index (“CPI”) reading shows a year-over-year increase of 4.9% and the core CPI (excludes food and energy) reading was 5.5%. As you can see, these readings are well above the Fed’s 2% target.

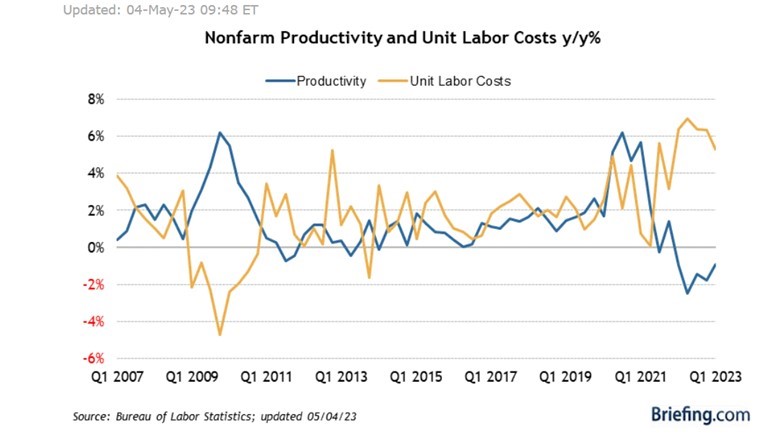

Economists continue to ponder why inflation became so stubborn after being so docile for the better part of the last 20 years. There are many factors likely contributing to this including large fiscal stimulus from Federal spending in 2020-2022, supply chain issues during the Covid-19 induced shutdowns, pent-up demand unleashed after the pandemic, lower labor force participation has increased wages, large government subsidies for green energy initiatives, and last but certainly not least, poor non-farm productivity. The US economy, since early 2021, has experienced increases in hourly compensation at the same time productivity has been declining:

Source: https://briefing.com

This combination is not conducive to long-term economic growth or improvement in the standard of living and will lead to increased automation and other labor-saving initiatives as businesses will have to find ways to be more efficient. Ultimately these steps will help bring the inflation readings down but it will take time (and capital) to install those new labor-saving machines and implement new business processes that will increase productivity over time. In the meantime, be prepared for the Fed to keep interest rates at higher levels (to discourage demand) than we have experienced the last 15+ years.

Without a doubt, these are INTERESTing times!

-

Tag Cloud

4-H Land Values Financials KOHL-laborations Essentials Newsletter balance sheet Interest Rates Weather Community Improvement Grants Land Classes appraisals FFA Auction Results Focus on Farming calendar employees land sales Farm Credit College Directors Cup Calendar contest cash flow FOMC INTERESTing Times FreshRoots